Executive Summary

AntiMyce brand seeks to establish a company in Canada and attract investors. The brand has made an invention in the field of biological control of plant pests which has reached to the mass production stage. AntiMyce, albeit with the help of an investor, intends to mass-produce this product in Canada and under the name of this country and export it to the whole world. This innovative plan is biological control of fungal pests to control Early Blight disease and citrus postharvest decay. One of the most important goals of the project is to produce an organic substitute for antifungal chemicals that will lead to the production of organic crops.

Our Mission

We are committed to provide environmentally friendly bio-pesticides. AntiMyce is also committed to deliver knowledge-based echo-friendly quality product.

Our Product

We produce a wide range of biological products for the academic, laboratory and industrial environments. One of the products developed based on an innovative idea is an antifungal product called “biofungicide”; the fungi that can infect and destroy a wide variety of agricultural products. The best method of disease management is prevention. It is very difficult to control the disease if established on the plant. Currently, after observing the first symptoms of the disease, the only recommendation is using chemical fungicide.

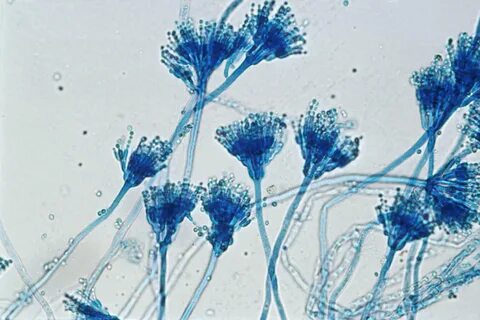

Farmers usually consult with plant protection experts to select the best and most effective chemical fungicides to control the disease. But the use of chemical methods to control the disease is ineffective and the fungicides have no effect on its control and are very harmful to the environment. Biological control is the best alternative for chemical pesticides to control plant diseases. Unlike chemical agents, they are less toxic, more useful and are easily degraded in the environment and are less allergic. They do not accumulate in food products and are much cheaper than chemicals. Soil naturally is the habitat of a large group of bacteria that originate from bioactive products with diverse pharmacological activities. These compounds widely have been used as pharmaceuticals and chemicals in medicine, veterinary and agriculture. Soil bacteria, especially Streptomyces, generate a wide range of antimicrobial and active substances, some of which have antifungal properties.

In general, this genus is capable of producing 167 biologically active and effective compounds against microorganisms. The characteristics of Streptomyces that differentiate them as biocontrol agents against fungi are the production of secondary metabolites such as enzymes and antibiotics. They do this by using soil organic matter and bio-buffers, and consist up to 40% of the population of microorganisms in dry soil. The most important enzyme in the control of pests and fungicides is Chitinase enzyme. This enzyme affects ketone and cell walls of the fungus and cause lysis of the cell wall of the fungus.

The Market

Global Fungicides Market Set For Rapid Growth, To Reach USD 15.74 Billion by 2024

The fungicide market was valued at USD 13.41 billion in 2018, and is expected to reach a value of USD 15.74 billion, registering a CAGR of 3.04% during the forecast period (2019-2024).

During the forecast period, the fungicides market is expected to have slower growth than other crop protection chemicals, like insecticides, due to lesser developments in the market and rapid adoption of fungal disease resistant crops, as compared to insect-resistant crops.

Based on the various types of fungicides, the global fungicides market is segmented into chloronitriles, dithiocarbamates, triazoles, strobilurins, benzimidazoles, mancozeb, and others. Among these, mancozeb was the leading segment in 2018 and it is also anticipated to be the fastest growing product segment of the market within the forecast period. This growth is attributed to the strong and rapid increase in demand for mancozeb, especially from China and India. Additionally, triazole was the second largest leading product segment of the global fungicides market in 2016. It accounted for more than 20% share of the total market. It is one of the active curative ingredients that are extensively used for each compound and it also has the ability to reduce production of pathogens that play a role in fungi sterol production. Thus, it is expected to witness the significant growth in the near future.

Major Players

Key Market Trends

Adoption of New Farming Practices Driving the Market

Fungicide usage and demand have fluctuated enormously over the years. The major factors that affect consumption pattern are changes in crop acreage, pest resistance, pesticide regulation, and technology adoption. Increased adoption and high effectiveness of fungicides have fueled the industry growth.

In the recent years, the popularity of bio-fungicides has increased among farmers, producers, and end consumers. Factors, like increasing demand for food safety and security, and government support, are driving the growth of this industry. The development of bio-pesticides or eco-friendly crop protection products has become a priority of the research and funding agencies all over the world. Growing profits in organic-based farming are influencing farmers to look toward the synthetic chemical alternatives to control plant health problems.

Our Competitive Advantages

The points of difference of the raised idea in compare with former activities:

- This product is biological and has no detrimental environmental effect.

- The cost of the product is approximately 70% lower than the fungicide pesticides.

- Producing this product is easier in compare with chemical pesticides.

- The survival of Streptomyces bacteria in the environment due to its high resistance to heat and reduced nutrients that eliminates the need for repeated spraying.

- The bacteria will not allow early growth of the fungus due to the release of antifungal substances and even prevent early infection.

| Year; | 2020 | 2021 | 2022 | 2023; | 2024 | 2025 |

| Revenue Growth Rate | _ | 130% | 130% | 120% | 120% | 120% |

| Gross Revenue | 1,500,000 | 1950000 | 2535000 | 3042000 | 3650400 | 4380480 |

| Total Investment | 2489531 | 2657830 | 2657830 | 2657830 | 2657830 | 2657830 |

| Total production costs | 1090935 | 1490000 | 1600000 | 1700000 | 1900000 | 2000000 |

| Profit and Loss (tax excluded) | 409064 | 460000 | 935000 | 1342000 | 1750400 | 2380480 |

| Profit and loss (including 19% tax |

331342 | 372600 | 757350 | 1087020 | 1417824 | 11928188.8 |

| ROI | 13.3% | 14.0% | 28.5% | 40.9% | 53.3% | 72.5% |

Start-up Financing Requirements

| Description | Applicant share | Amount | Percent |

| Fixed capital | 1157830.196 | 47% | |

| Working capital | 1331701.3 | 53% | |

| Total investment | 2.489.531.50 | 100% |

For the First year

| Gross income; | 1500000 $ |

| Total cost | 1090935.081 $/td> |

| Gross profit | 409064.9192 $ |

| 19% tax; | 77722.33465 $ |

| Net profit | 331342.5846 $ |